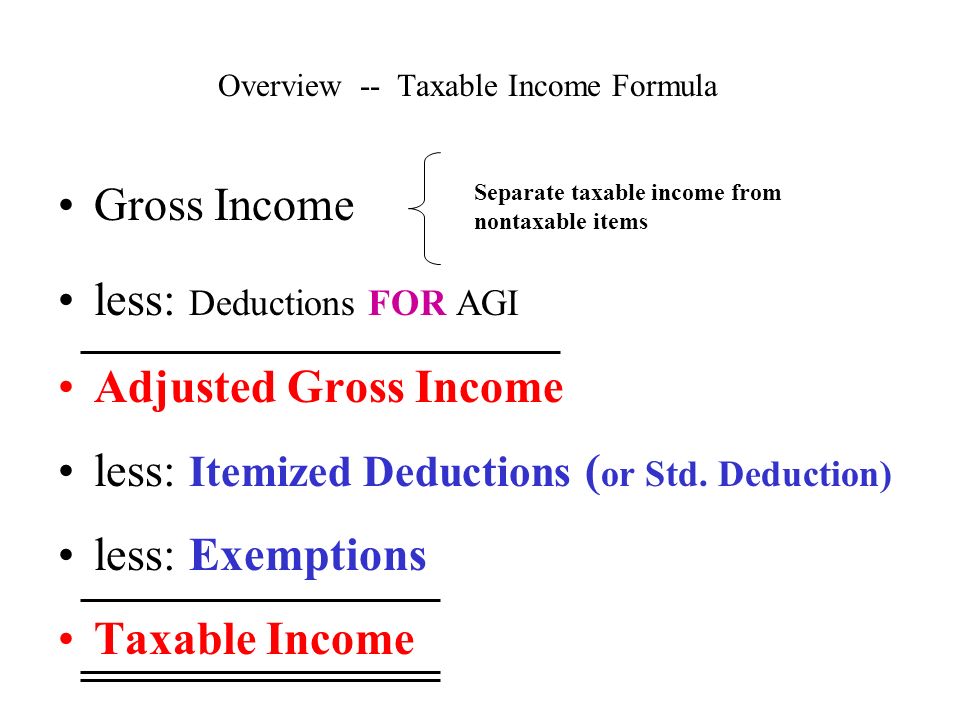

Taxable income formula

Federal taxes State taxes Total Taxes. Hence Company ABC has to undergo an income tax of 500000 in the current accounting period based on the tax rate of.

Taxable Income Formula Examples How To Calculate Taxable Income

Estimate Your Taxes And Refunds Easily With This Free Tax Calculator From AARP.

. Income on which tax must be paid. Expenses you can subtract from adjusted gross income to determine your taxable income. The next 30575 is taxed.

The first 9950 is taxed at 10 995. Access IRS Tax Forms. Calculating taxable income is very easy and hassle free.

Income Tax of Company ABC 2000000 x 25 500000. Divide the companys total tax liability by the statutory tax rate listed on the governments tax table to. Formula for Calculating Federal Taxable Income Calculating Taxable Income.

Tax Filing Is Simple And Free For Those Who Qualify With TurboTax Free Edition. Over 50 Million Returns Filed 48 Star Rating Fast Refunds and User Friendly. Gross Profit Revenue Cost of Goods Sales COGS Operating profit Earnings before Interest.

For example if the business had a total taxable income of 100000 and the tax rate is 10 the estimated income tax payable will be 10000. Complete Edit or Print Tax Forms Instantly. Ad Home of the Free Federal Tax Return.

Revenues Deductions Taxable Income. There are generally used equation which is derived from the income statement. E-File Directly to the IRS.

You can think of it like a formula. In general any revenue is taxable. Taxable income x tax rate income tax expense.

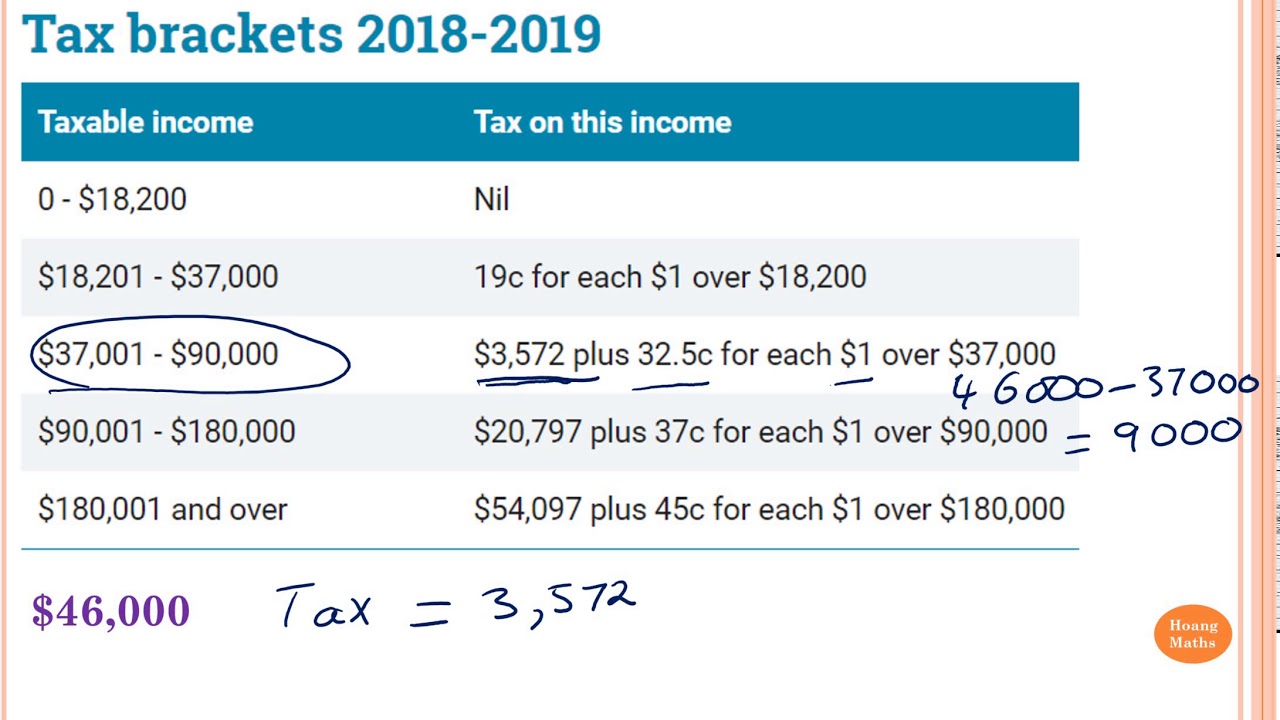

Taxable income refers to any individuals or business compensation that is used to determine tax liability. Using the brackets above you can calculate the tax for a single person with a taxable income of 41049. Over 50 Million Returns Filed 48 Star Rating Fast Refunds and User Friendly.

Tax credits lower the amount of taxes you have to pay while tax deductions lower the amount. Revenues is any income your business earns. To calculate the income tax to be paid the customer has to add up all the income received and the tax liability is then reduced by.

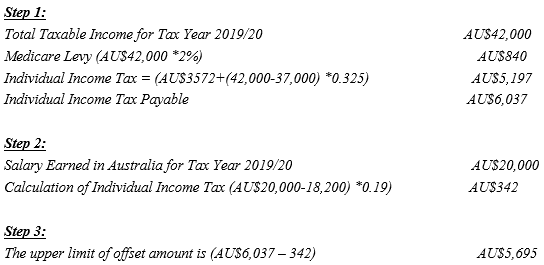

E-File Directly to the IRS. Ad Complete IRS Tax Forms Online or Print Government Tax Documents. Taxable Income Formula.

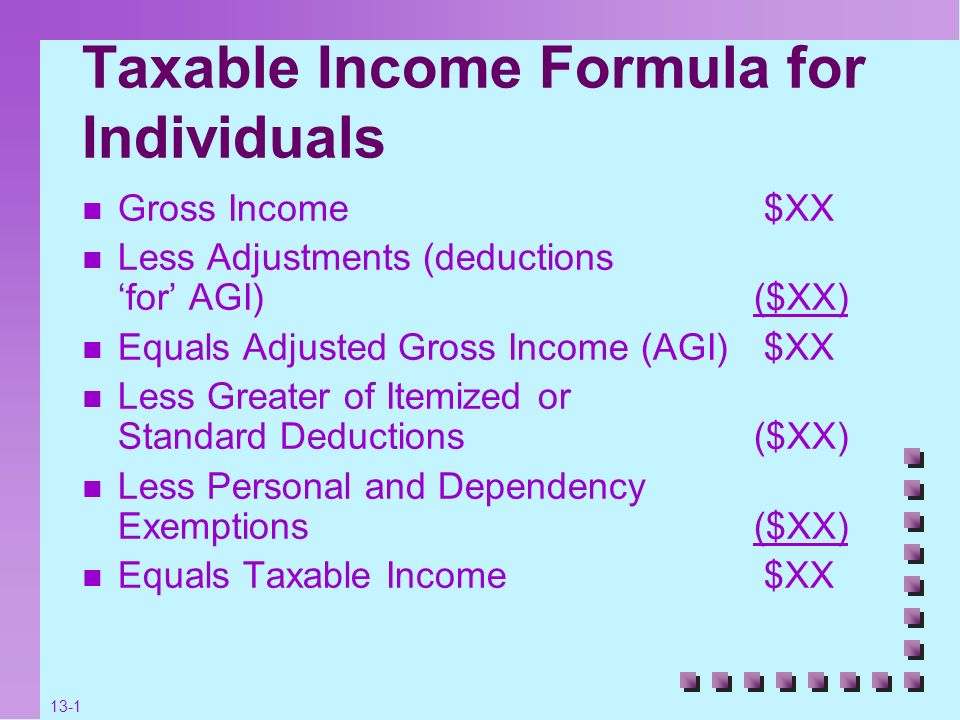

This is not the same as accounting income. Taxable income only represents the taxable portion of a companys profits. Corporate taxable income is simply corporate gross income minus deductions allowable under US tax law.

Ad See If You Qualify To File For Free With TurboTax Free Edition. Gross Income x Tax Rate Taxable Income. Ad Home of the Free Federal Tax Return.

Your gross income minus all available deductions is your taxable income. The total income amount or gross income is used as the basis to. The first step in computing your AGI is to determine your total gross income for the year which includes your salary in addition to any earnings from self.

Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. Compare that amount to your tax bracket to estimate the amount youll owe before applying.

How To Calculate Income Tax On Salary With Example Best Sale 53 Off Www Quadrantkindercentra Nl

How To Calculate Income Tax On Salary With Example Online 55 Off Www Ingeniovirtual Com

How To Calculate Income Tax On Salary Shop 60 Off Www Ingeniovirtual Com

Taxable Income Formula Examples How To Calculate Taxable Income

Taxable Income Formula Calculator Examples With Excel Template

Taxable Income Formula Examples How To Calculate Taxable Income

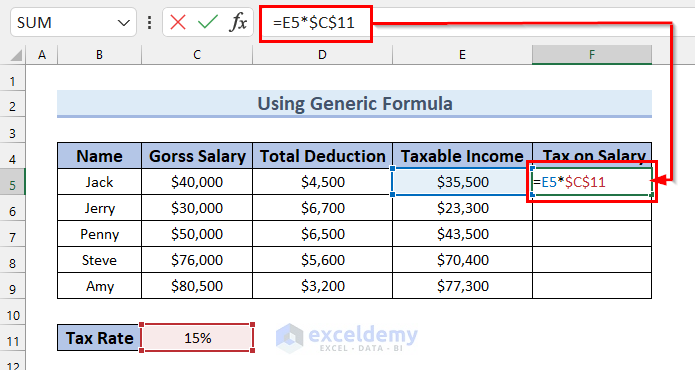

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

Calculating Tax Payable Part 1 Youtube

California Tax Expenditure Proposals Income Tax Introduction

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

Deferred Tax Asset Definition

How To Calculate Income Tax On Salary With Example Best Sale 53 Off Www Quadrantkindercentra Nl

Chapter 3 Calculate Taxable Income Personal And Dependency Exemptions Ppt Video Online Download

Taxable Income Formula For Individuals Ppt Video Online Download

How To Calculate Income Tax On Salary With Example Best Sale 53 Off Www Quadrantkindercentra Nl

How To Calculate Tax On Salary Cheap Sale 58 Off Www Ingeniovirtual Com

How To Calculate Income Tax On Salary With Example In Excel

Calculate Income Tax In Excel How To Calculate Income Tax In Excel