Reinvestment rate formula

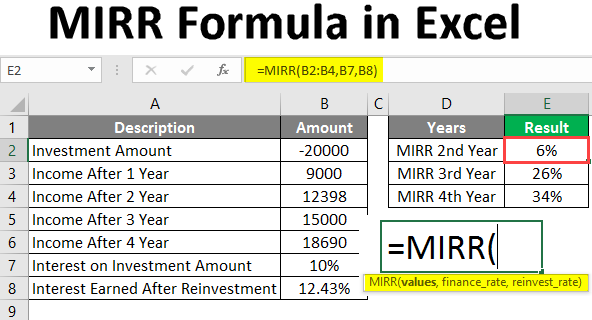

Using Modified Internal Rate of Return formula. The formula for a project that has an initial capital outlay and three cash flows follows.

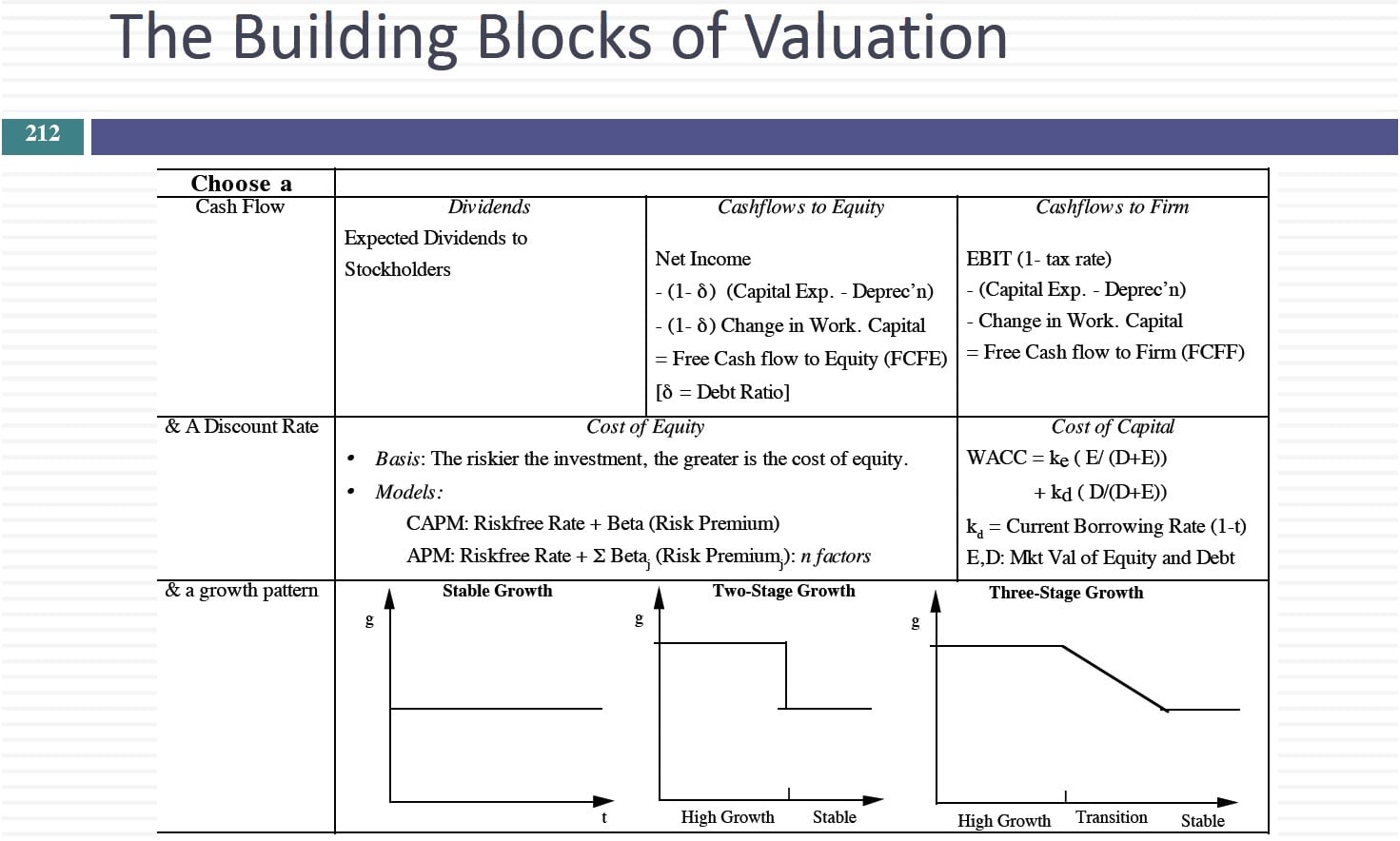

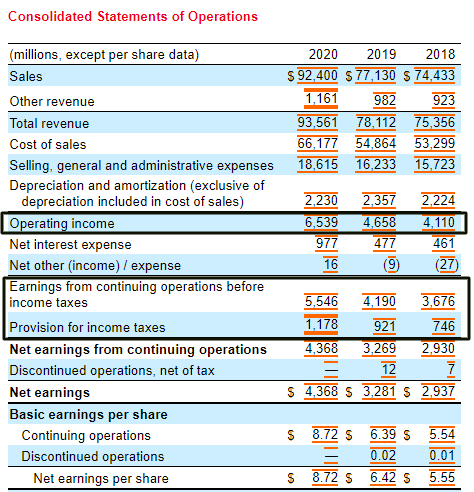

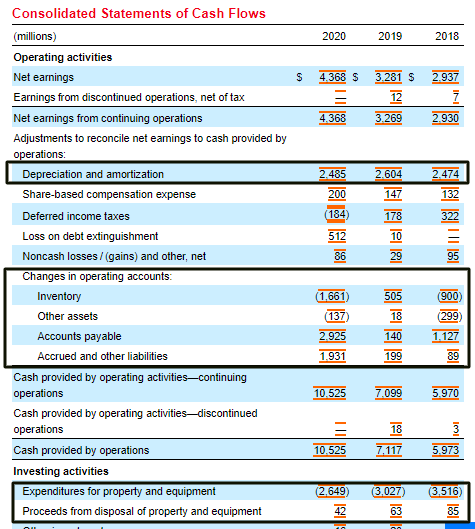

Corporate Valuation Free Cash Flow Approach Ppt Download

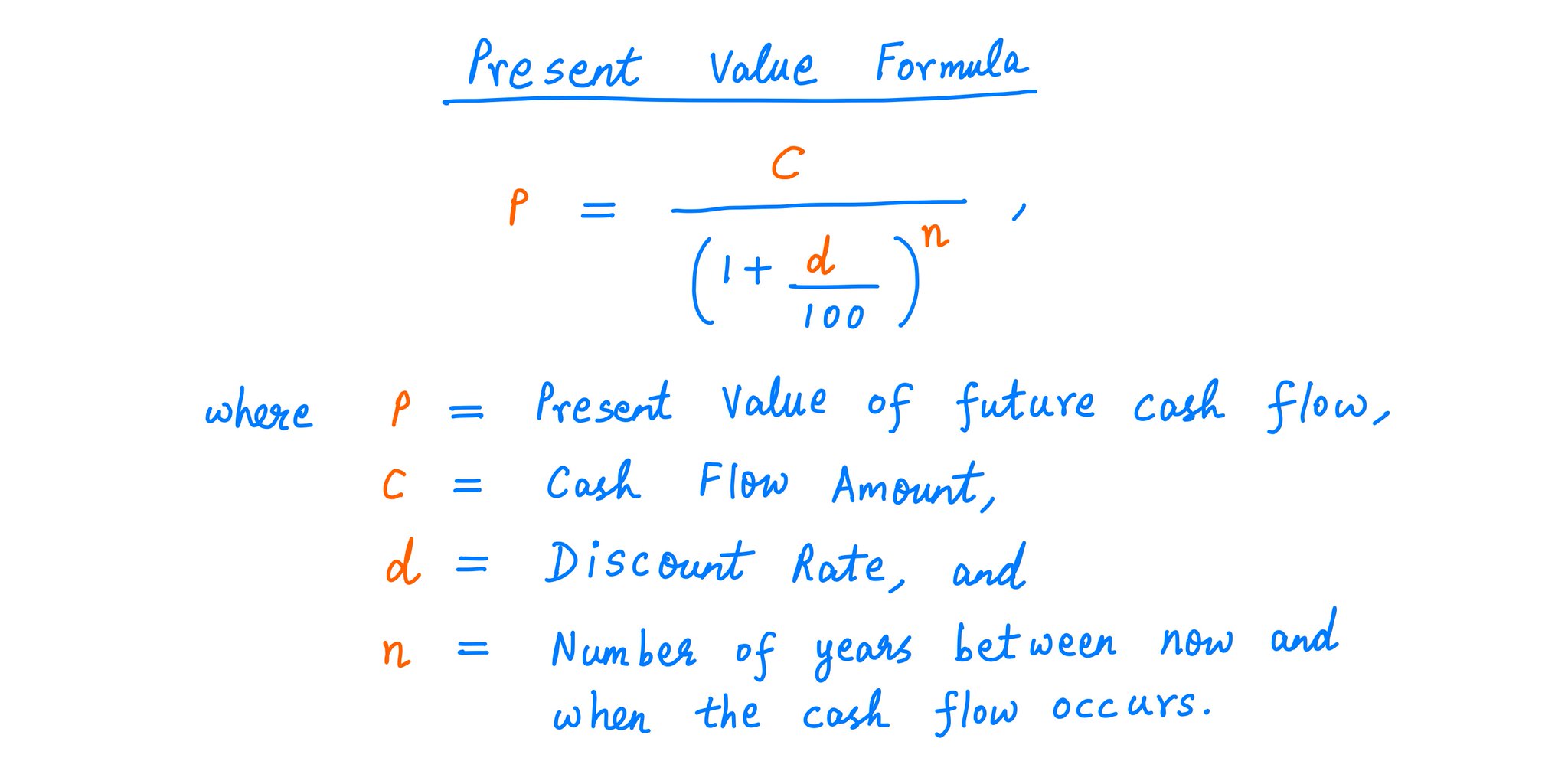

N P V C F 0 1 r.

. Common examples of yield spreads are g-spread i-spread zero-volatility spread and option-adjusted spread. The range C5 to E5 represents the investments cash flow range and cells D10 and D11 represent the rate on corporate bonds and the rate on investments. It doesnt allow us to isolate a variable and solve.

Net Worth by Age Calculator for the United States. CAP Rate Formula. A risk-free rate of return formula calculates the interest rate that investors expect to earn on an investment that carries zero risks especially default risk and reinvestment risk over some time.

Market Risk Premium Formula Calculation. The MIRR formula in Excel is as follows. Monthly Median Value from 1953-2022.

Reinvestment Rate Compounding rate of return at which positive cash flow is. Internal rate of return IRR is a method of calculating an investments rate of returnThe term internal refers to the fact that the calculation excludes external factors such as the risk-free rate inflation the cost of capital or financial risk. CAP rate calculation Buildings Profit BI Buildings Purchase Price.

Average Median Top 1 and all United States Household Income Percentiles. For example lets say the building has a sale price of 100000 and after all expenses including insurance hydro and utilities the profit is 10000. The image below shows the formula behind.

But other than this distinction the calculation steps are the same as in the first example. It is the rate of return that a bondholder earns if he holds the bond till maturity and receive all the. Market Risk Premium Expected Rate of Return Risk-Free Rate.

It leads the Internal Rate of Return to posit an overestimation of future cash flow. Thats right - the actual formula for internal rate of return requires us to converge onto a solution. The forward rate agreement is an agreement that will allow.

1147 title VIII of the Housing and Community Development Act of 1977 12 USC. The Community Reinvestment Act CRA PL. Cash Flows Individual cash flows from each period in the series.

IRR analysis also assumes a constant reinvestment rate which may be higher. Dividend yield 350 50 007 Now entering the variables into the dividend reinvestment formula. Download the Free Template.

CAGR Example Return Calculation. Typically reinvestment takes place at the cost of capital and not in the rate of return as inferences drawn solely from IRR wrongly posit. The premium is 8 4 4.

The SP 500 generated a return of 8 the previous year and the current interest rate of the Treasury bill is 4. You can choose to enter into a contractual agreement called a forward rate agreement to eliminate your reinvestment risk. It is usually closer to the base rate of a Central Bank and may differ for the different investors.

Stock Total Return and Dividend Reinvestment Calculator US Historical US Home Prices. The formula for the approximate yield to maturity on a bond is. Financing Rate Cost of borrowing or interest expense in the event of negative cash flows.

Yield spread is the difference between the yield to maturity on different debt instruments. The CAP rate will be calculated as. The table is structured the same as the previous example however the cash flows are discounted to account for the time value of money.

2901 et seq is a United States federal law designed to encourage commercial banks and savings associations to help meet the needs of borrowers in all segments of their communities including low- and moderate-income. It is the rate of interest offered on sovereign. First calculate dividend yield using the formula Dividend yield annual dividend stock price 100 If a share price is 50 and the annual dividend is 350 dividend yield is calculated using the formula.

MIRRcash flows financing rate reinvestment rate Where. The method may be applied either ex-post or ex-anteApplied ex-ante the IRR is an estimate of a future annual rate of return. It assumes the reinvestment rate as the companys positive cash flows while the finance cost Finance Cost Financing costs refer to interest payments and other expenses incurred by the company for the operations and working management.

CAP rate 10000 100000 10. The health system said in a statement that it will cut 400 positions from its staff of 64000 as part of a cost-reduction plan. Here each cash flow is divided by 1 discount rate time period.

Hence according to the forward rate formula to calculate the forward rate. Forward rate 1 006 5 1 003 3 1 5 - 3 - 1 1066. Year 0 Year 1.

At the end of the current period the company has generated 100 million in revenue and this figure is anticipated to grow by the following growth rates each year. However that doesnt mean we cant estimate and come close. Suppose we are tasked with calculating the compound annual growth rate CAGR of a companys revenue.

SP 500 Periodic Reinvestment Calculator With Dividends. The Internal Rate of Return formula is as follows. Estimated Yield to Maturity Formula.

The formula is as follows. Bond yield is the internal rate of return of the bond cash flows.

How To Use The Excel Mirr Function Exceljet

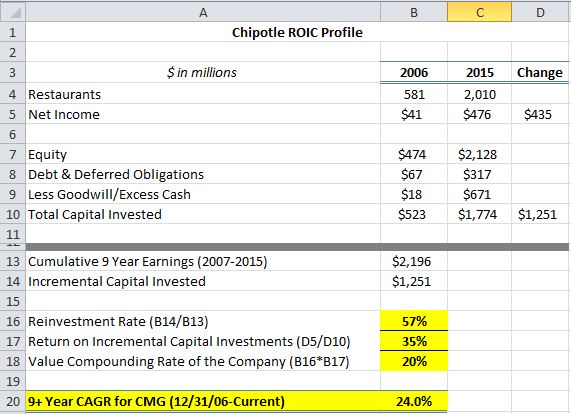

Calculating The Return On Incremental Capital Investments Saber Capital Management

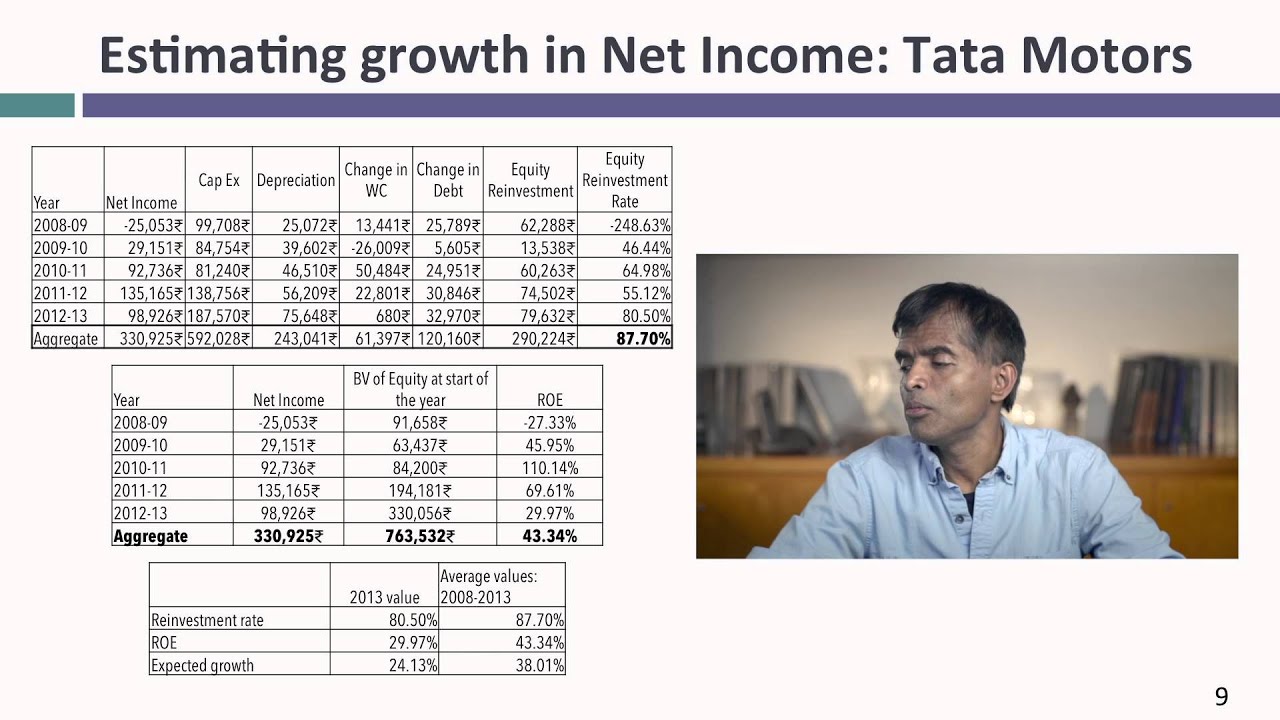

Session 10 Growth Rates Terminal Value Model Choice Youtube

10 K Diver On Twitter 13 Here S A Formula To Calculate The Present Value Of A Future Cash Flow Along With A Couple Examples As You Can See The Formula Takes A Cash

Level I Cfa Tutorial Fixed Income Reinvestment Assumption In Calculating Yield To Maturity Ytm Youtube

Reinvestment Rate Formula And Example Calculator Excel Template

Session 31 Cash Flows Growth Rates Youtube

Reinvestment Rate Formula And Example Calculator Excel Template

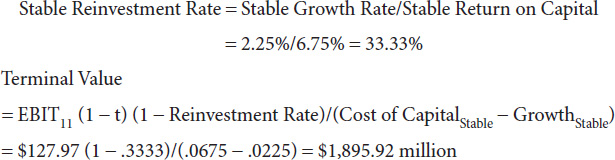

Reinvestment Rate Terminal Value Model Choice

Mirr Formula In Excel How To Use Mirr Function With Examples

The Ultimate Guide To Advanced Discounted Cash Flow Analysis Dcf How To Value A Company Stockbros Research

How To Use Reinvestment Rate To Project Growth For Valuation

The Light Side Of Valuation How To Value Growth Companies Informit

How To Use Reinvestment Rate To Project Growth For Valuation

Cash Reinvestment Ratio Formula Calculator Updated 2022

Myth 5 3 Growth Is Good More Growth Is Better By Aswath Damodaran Harvest

The Fundamental Determinants Of Growth